Status Quo Instant Payment

Everything about the decision,

deadlines and implementation

The representatives of the EU Parliament, the EU Commission and the EU Council have agreed in a trilogue on the regulation of instant payments and submitted a corresponding proposal for a regulation. This proposal was finally confirmed by the EU Parliament and published in the Official Journal. The deadlines for implementation are now running. The decision is a significant step towards a faster, more efficient and standardised payment system in Europe and will bring about far-reaching change in the banking landscape.

This is how it continues now:

- The first deadline ends on 9 January 2025, when banks and institutions must be able to receive instant payments (IP passive).

- Verification of Payee, i.e. IBAN name check, raises questions. More on this in our blog post (German version only).

Ambitious timetable

The deadlines at a glance

The ambitious implementation deadlines now require fast action. The regulation provides the following timeframes for financial institutions in the eurozone:

- 9 months for incoming instant payments (IP passive)

- 18 months for active instant payments (IP active) and the IBAN name check

- Non-euro countries = 33/39 months (passive/active)

The technical details of the name check are still the subject of open discussions.

The urgency of the situation should not be underestimated. The European banks are called upon to act immediately in view of the ambitious timeframe.

- Instant Payment Passive will be required by 09 January 2025.

- An implementation for Instant Payment Active and the IBAN Name Check by 9 October 2025

The associated 24/7/365 availability places particular demands on the IT infrastructure and existing systems. As a bank, it is therefore advisable to start immediately with functional and technical analyses.

Further contents of the regulation

What else you should know.

- Customers should be able to set amount limits per day and per transaction. These amount limits apply to both individual and bulk payments

- Institutions that offer bulk transfers in the SEPA environment must also do so in the SCT-INST area in future

- E-money and payment institutions must be passively and actively ready 36 months after entry into force

- In order to include e-money and payment institutions in the obligation, they are to be given access to the central bank and included in the definition of an “institution” in accordance with Directive 98/26/EC

- Definition of electronic money institutions in accordance with Article 2(1) of Directive 2009/110/EC

- Definition of payment institutions in accordance with Article 4(4) of Directive (EU) 2015/2366

- Deadline for daily sanctions screening = 9 months after entry into force

Pioneers in the field of instant payments

van den Berg is your strong realisation partner

- Project experience since 2017

- Unique position as a registered instructing party in the TIPS environment: This enables a quick and uncomplicated connection to TIPS without our customers having to establish a direct connection to the SWIFT infrastructure.

Nevertheless, an overall project can take 6-18 months and requires careful planning. Project management, which can be the responsibility of either the bank or a consultancy firm, is important in this context. This is because resources are also becoming scarcer at consulting firms. If necessary, Foconis can provide support with mediation.

Instant payments offer a contemporary opportunity to reorganise payment transactions in Europe and the time to act is now. Our customers can benefit from Foconis’s extensive experience and efficient implementation process. However, the tight timeframe for implementation leaves little room for delays and blockades. The extensive adjustments to systems, IT infrastructure and new business processes, as well as potential resource bottlenecks, make it clear that bank management must prioritise the introduction of instant payments.

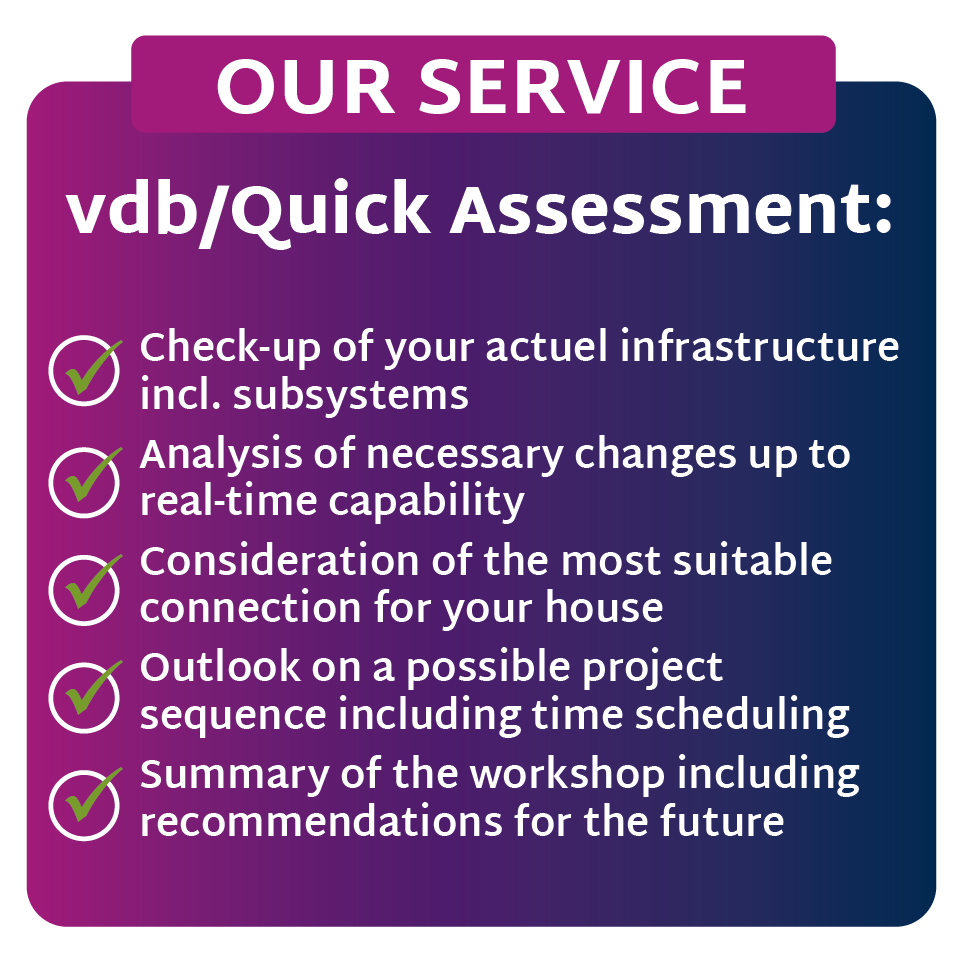

Your project start: Quick Assessment

Clarity as the basis for a common path

Even banks with existing instant payment functions need to review their processes with regard to the new regulations. The appeal is clear: act now and initiate the introduction of instant payments. Time is of the essence and the risk of capacity bottlenecks is high. Let’s usher in a new era of instant transactions together to make the European financial landscape more responsive and dynamic. We are happy to support you with a quick assessment.

Our Expert